News

What is a FAIR TAX for Illinois?

SEIU Local 73 is part of the Responsible Budget Coalition made up of over 300 organizations concerned about state budget and tax issues. Its is a non-partisan coalition and focused on good policy, not electioneering. The coalition is guided by 3 core principles:

- No more cuts to vital programs and services

- Adequate revenue to repair and damage done and make smart investments

- Fairness in raising revenue

Illinois’ tax structure is unfair and inadequate

We need bold, progressive policies to help working families get ahead, including the implementation of a fair tax. Right now Illinois suffers from one of the most unfair income tax systems in the country, a system that has helped cause many of the challenges our state faces and which makes solving them very difficult. A fair tax would ensure everyone pays their share, boost the middle class, and increase much-needed revenue for the state.

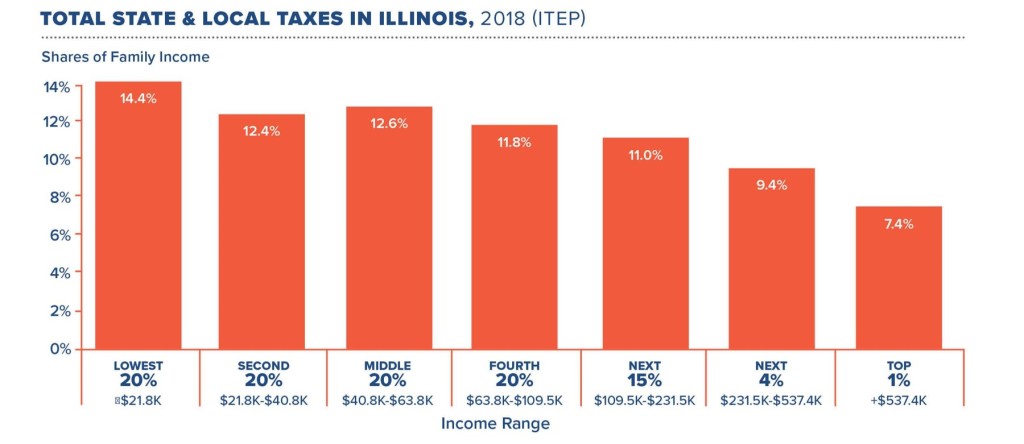

The flat tax is unfair. Illinois is the 8th most regressive taxing state in the nation. 20% of Illinois’ lowest earners pay more than any other Midwestern state and have 2 times the tax burden of the wealthy.

Illinois has a fiscal crisis. In 2020, the budget deficit will be $3.2 billion. We have $15 billion in backlog-related debt. Illinois has a structural deficit, meaning that if the state doesn’t change tax policy or service levels, revenues will grow more slowly than spending each year.

FAIR TAX IS THE ANSWER

What is the fair tax? With higher rates for people with higher incomes and lower rates for people with lower incomes, it allows for tax breaks to working families while requiring rich people and big corporations to pay their fair share.

- Illinois is 1 of only 4 states that mandates a flat tax in its constitution

- 32 states, D.C., and the Federal Government use a fair tax structure

- A fair tax helps create a more equitable tax system by placing a greater tax burden on affluent families than on low and middle income families, when tax burden is measured as a percentage of income

| FLAT TAX | FAIR TAX |

| Under a flat tax, a minimum wage worker pays the same percentage of their income on state income tax as does a millionaire. When you add other taxes, like sales tax, lower income families end up paying a higher percentage than the rich in taxes. | Under a Fair Tax, millionaires and minimum wage workers pay a different rate based on their income. The state applies lower tax rates to lower income households and higher tax rates to higher income households. |

|

Illinois’ flat tax places an unfair burden on low and middle-income families and cannot sustain the state’s revenue needs. |

A Fair Tax will ensure Illinois’ ability to fund schools and social services and help return Illinois to fiscal stability. |

Governor Pritzker’s Fair Tax plan would generate $3.4 billion in revenue per year, most of it from millionaires. A Fair Tax could bolster funding needed for critical public investments without balancing the budget on the backs of low and middle-income families

With the Governor’s Fair Tax Plan:

- 97% of taxpayers get tax relief

- Same of or lower tax rate for all income under $250,000

- Expanded property tax credit and child tax credit

How will your household’s taxes change?

CLICK to calculate how much your family would pay under the Governor’s new Fair Tax Plan.

We must pass a resolution to put the Fair Tax on the ballot in both the Illinois House and Senate by the end of this legislative sessions. The resolution requires a 3/5 vote. The question would then be placed on the ballot for the 2020 general election. We need 60% of voters to vote in favor on the ballot question, or more than half of all the people who vote in the election. If we vote in favor, the constitution is amended.

Contact your state senator and state representative to express your support for a fair tax!

Local 73 members are springing into action, working to educate the public on the Fair Tax and what it would mean for Illinois.